The Financial Advice process

Our Financial Advice process takes you through the steps you need to plan for your retirement as a pre-retiree, manage your retirement and estate planning as a retiree, or to achieve the best outcomes when arranging finances when your loved ones transition into aged care.

Read on to discover what you can expect from a tried, tested, and trusted process…

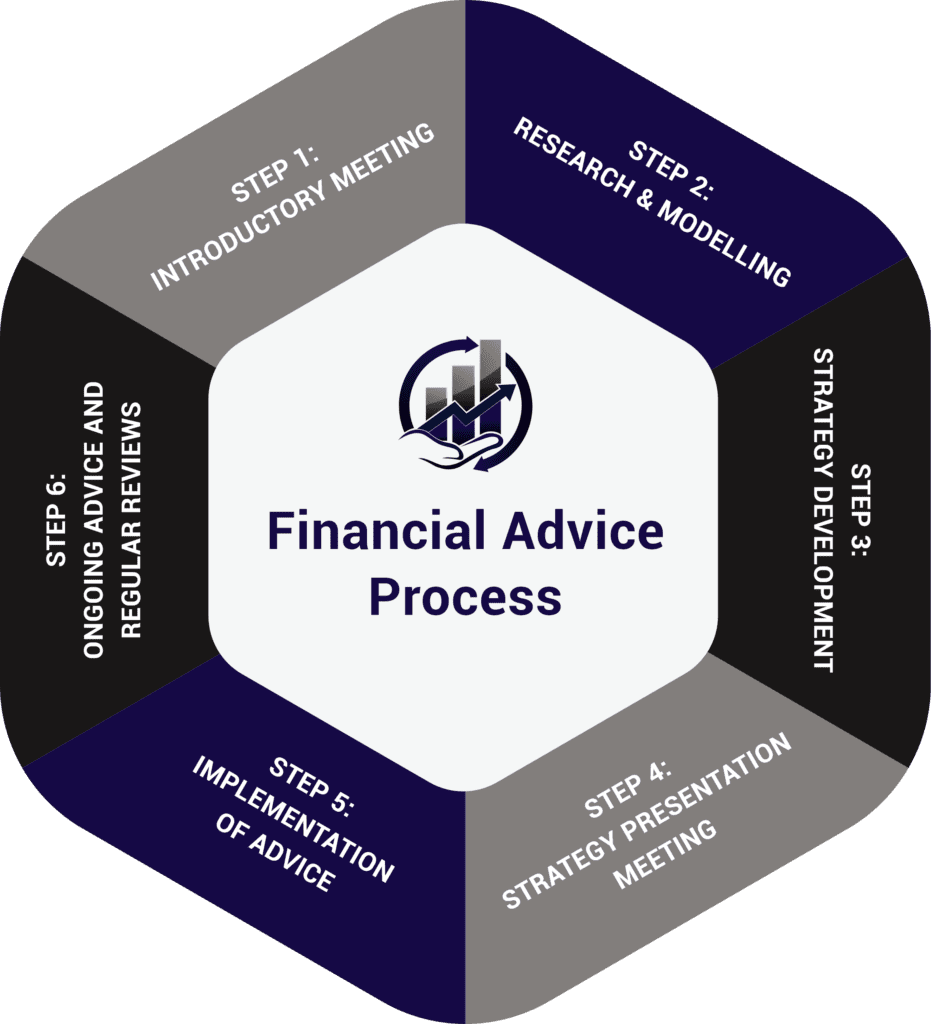

The 6 steps in the Financial Advice process

In offering you full-scale value, and in providing a holistic financial planning service, we follow the below 6-step Financial Advice process.

STEP 1: INTRODUCTORY MEETING

At this meeting we get to know you, to understand your goals, priorities, concerns, and aspirations, and you have an opportunity to get to know us and ask questions.

Tip: Come prepared knowing where you’d like to be financially in 5, 10, and 20 years, what lifestyle you want, and what you need to live it. Think of your concerns and how you would like to address these. Bring the details of your income and expenses, your budget or an idea of how much you spend, your pay slips, tax returns, and a list of your assets and liabilities. Making this information available will make your first meeting more productive.

STEP 2: RESEARCH & MODELLING

Following acceptance of the engagement offer, we commence the research, assessment, and modelling of your present and alternative scenarios to help you achieve your goals. This involves gathering your financial details, using tools and calculators, considering several strategies, researching your existing products and alternatives, modelling comprehensive long-term projections of your financial position into the future, and comparing your current situation and proposed strategy outcomes.

STEP 3: STRATEGY DEVELOPMENT

Preparation of your personalised plan in the Statement of Advice – a formal document containing our detailed recommendations, explanation of recommended strategy, alternative considerations, comparisons of your position before and after implementing our advice, as well as projections of your financial position into the future.

STEP 4: STRATEGY PRESENTATION MEETING

Presenting your tailored financial strategy to you and explaining how our advice will help you achieve your goals. This is your opportunity to ask questions and gain clarity on your financial plan.

STEP 5: IMPLEMENTATION OF ADVICE

We undertake all preparation, lodgment, and tracking progress of administrative forms and applications, ensuring errors are quickly rectified along the way. We then suggest having a post-implementation meeting, at which we discuss the implemented changes and ensure that you are comfortable with them.

STEP 6: ONGOING ADVICE AND REGULAR REVIEWS

Our ongoing annual review process enables us to be proactive and ensure your financial strategy remains relevant to your situation and your goals, with any necessary adjustments made as required. This also gives you and your family access to your trusted adviser as a sounding board resource, so you are supported with any financial matters that arise.

Success story

Specialist financial advice adds value to seemingly simple low-means scenario

Giovanni and Vincenza are in their late 80s. They lived in their family home, managing their lifestyle on a full age pension, Giovanni’s small overseas pension, and a small personal pension fund worth $50,000 in Giovanni’s name. They’ve managed to accumulate approximately $115,000 in their bank accounts.

Sadly, following the deterioration of Vincenza’s dementia in recent years, the family decided to place her into Aged Care, with a special memory support unit for dementia residents. Giovanni remained at their home, so the home was not included in Vincenza’s means-tested assessment, and Vincenza was therefore qualified as low-means resident. As such, she did not have to pay an accommodation deposit, but had to pay a daily accommodation contribution of ~$20 per day instead; ~$7,300 per annum. The basic daily care fee and extra services fees also added another cost of $24,600 per annum.

The couple’s ‘illness-separated’ status also resulted in an increase of their age pension, now being paid a single rate. And with Giovanni maintaining the house and funding his lifestyle, the client’s combined cashflow was just breaking even.

Despite this scenario being reasonably straightforward, following our detailed analysis of 5 different accommodation payment options and scenarios, we still found improvements:

– Paying a refundable accommodation contribution using their bank account savings, rather than the daily payments, has saved the couple ~$7,300 per annum.

– We advised that Giovanni’s personal pension investment be adjusted for a capital secure investment type, and that his superannuation beneficiary nomination for Vincenza be changed, given the circumstances.

– We offered a Centrelink nominee service, ensuring that Centrelink records were updated so the couple continue receiving their current rate of age pension.

Disclaimer: The above case study does not take into account your own personal and financial circumstances and should not be used as a basis for financial decisions. It is essential to seek advice tailored to your specific circumstances, so that your financial path can be navigated with precision and care.

FAQs

What are the 6 steps in the financial planning process?

The 6 steps in the financial planning process are:

STEP 1: Introductory Meeting

STEP 2: Research & Modelling

STEP 3: Strategy Development

STEP 4: Strategy Presentation Meeting

STEP 5: Implementation of Advice

STEP 6: Ongoing Advice and Regular Reviews

What happens when you meet a Financial Adviser?

When you first meet with a Financial Adviser, it is an opportunity for that adviser to get to know you, to better understand your goals, priorities, concerns, and aspirations, and for you to get to know the adviser, to see if you like their approach and feel you can trust them to help you.

At Financial Balance Group, we recommend you come prepared to this initial meeting, knowing where you would like to be financially in 5, 10, and 20 years; what lifestyle you want, and how much money you would need to live it. Think of what your concerns are and how you would like to address these. Bring the details of your income and expenses, your budget or an idea of how much you spend, your pay slips, tax returns, and a list of your assets and liabilities. Making this information available will make your first meeting more productive.

What kind of process is financial planning?

Financial planning is a consultative process, which involves a detailed discussion with you about your goals, plans, priorities, concerns, financial and personal circumstances. This discussion is followed by the research and consideration of potential strategies, modelling projections, and assessment of alternatives. The result – comprehensive advice – is captured in the Statement of Advice document, which contains all recommendations, rationale, research outcomes, alternative considerations and long-term projections. At the following meeting, we explain our advice with all relevant details and ensure that you understand and are comfortable with it. This detailed and robust process ensures that you receive advice of high quality, and that you fully understand and are comfortable with the recommendations.

What is an example of the financial planning process?

For the best example of a trusted financial planning process, view the Financial Balance Group Financial Advice process.